Davidson Cahill Morrison LLP 2024 Holiday Party

On December 12, 2024, the lawyers and staff of Davidson Cahill Morrison LLP celebrated the holiday season together with a family style lunch at Gusto 501.

Offices in Toronto, Huntsville and Bowmanville

You’ve worked hard. You and your family have saved diligently for years. Congratulations you’ve bought a house. Unfortunately, it wasn’t built properly and might even be too dangerous for you to live in. What do you do now?

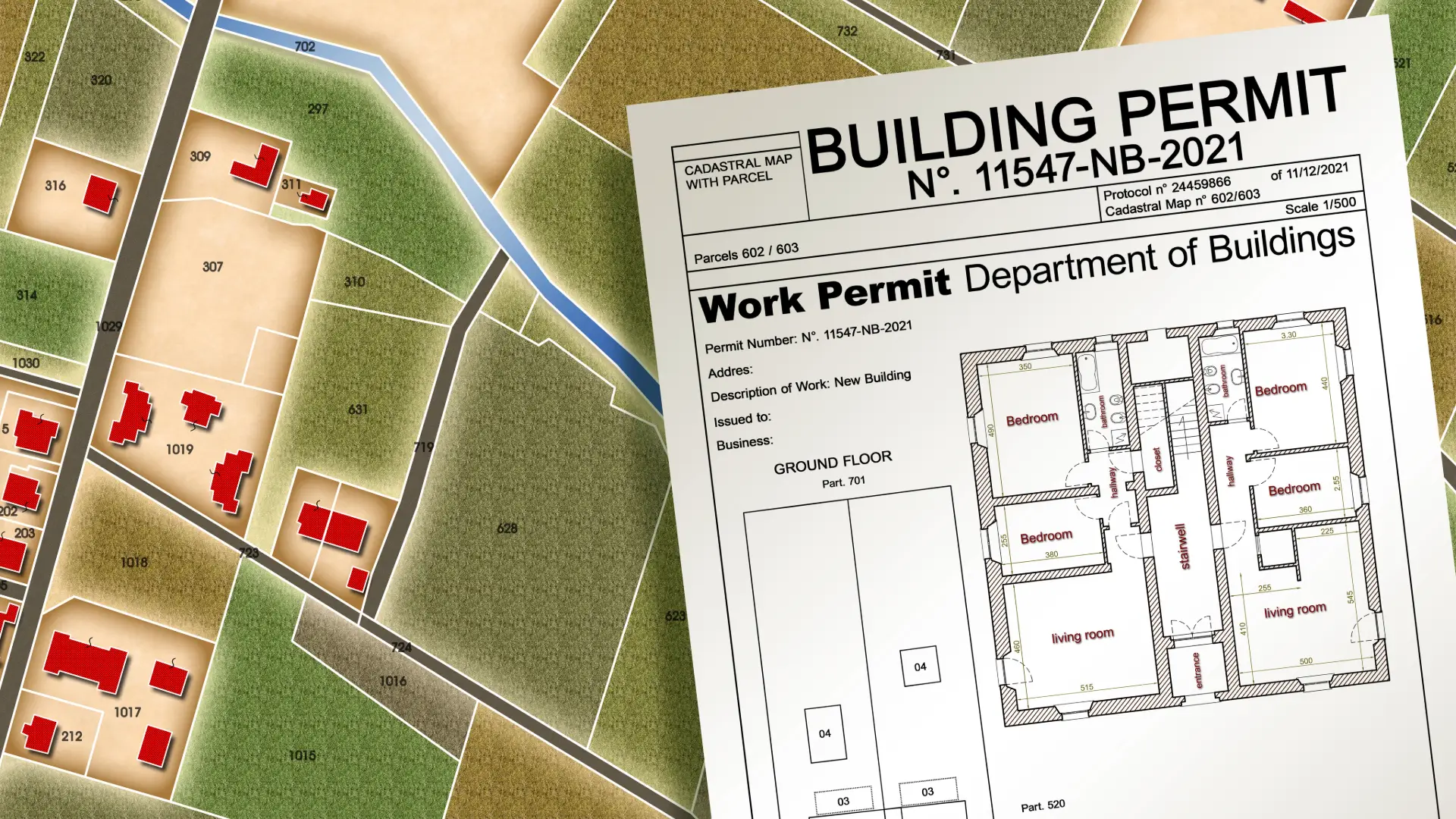

In the first post in this series, I discussed the MacDonald case and the fact that the residential title insurance polices sold in Canada cover much more than strictly “Title” matters. In this Commentary I turn to one of those non-Title or “Land” coverages – commonly called “Building Permit” coverage. Although the policies sold in Canada are not standardized (they should be) most contain coverage like the following from Chicago Title’s policy:

“You are forced by a Governmental Authority to remove or remedy your existing structures or any part of them – other than boundary walls or fences – because any portion was built without obtaining a required building permit from the proper Governmental Authority.”

I need to pause for a moment before analyzing this coverage. At Davidson, Cahill, Morrison LLP we have pursued a number of legal remedies for clients that have found themselves living in a poorly built home. These include various combinations of actions against Vendors; Home Inspectors; Lawyers; Builders; Tarion (in Ontario the Builders’ Warranty company); Engineers; Architects; and Municipalities. Any one, or all, of these parties can have duties that, depending on the circumstances, they owe to owners of improperly built homes. Actions against these various parties are beyond the scope of this Commentary on title insurance coverage.

Now what does “Building Permit” coverage cover? The first thing to note is that just because you have a problem with your structure the coverage is not necessarily engaged. To claim under this Covered Risk you must be being forced by a “Governmental Authority”. Governmental Authority is a defined term in most of the policies. Chicago Title for example defines “Governmental Authority” as:

“… any department or division of the Government of Canada, or any province or territory or of the municipality in which Your Land is located which has jurisdiction with respect to matters of building and zoning compliance.”

Revenue Canada is clearly a “department or division” of the Government of Canada but they don’t have jurisdiction with respect to matters of building and zoning compliance. Normally then, the “Governmental Authority” will be the Building Department of the Municipality where the property is located. It is less likely, but possible, that a Provincial “department or division” might be involved, as might a Federal authority on, for example, Reserve Lands.

What is “forced”? In denying claims the title insurers have taken the position that “forced” can only mean being forced by a properly issued Work Order. We don’t agree. The policy could read “forced by a Work Order” and define “Work Order” but it doesn’t. “Forced” then is open to interpretation. Imagine you are planning a renovation but the City won’t permit your renovation until you repair your existing structure. You are being “forced”. You can’t use and enjoy your property in the way you’d like until you repair it.

Note that Chicago Title has added “or remedy” after “remove” following the MacDonald case previously discussed.

I turn now to the word “any”. Note that the coverage applies if you are being forced to remove or remedy your existing structures or any part of them. Structures is plural meaning coverage is engaged if you are being forced to remove or remedy a portion of the garage or a shed as opposed to the house. This means that should you be forced to fix the house due to the fact an addition (or garage, shed, deck, studio, other structure) was added without a building permit you have coverage for the repairs needed on the house – not just those needed on the other structure. In other words what needs to be fixed does not need to be the portion built without the permit. A deck may have been added without a permit but its addition is causing structural or water penetration issues in the permitted house that the City wants remedied. The insurers don’t always agree with our position but it is what the covered risk says. Note also the reference to “existing” structures. These policies speak as of the Date of Policy which is (normally) the Closing Date of the purchase. We are therefore speaking about structures that were in existence when you closed and not structures you may have added after closing.

The next phrase is important: “built without obtaining a required building permit”. You will want to check your policy but the word “required” has not always been included here. It has been added, understandably, to make clear that the risk is only covered if the improvement on the land had to be permitted when it was built. Homes built before 1975 in Ontario may not have needed a permit.

Now what is a “Building Permit”. A Building Permit is an authorization from a Municipality (pursuant to authority granted by the Building Code Act, 1992, S.O. 1992, c. 23) for specific works to be completed on a property. Building Permits are issued so as to ensure that the project complies with building, zoning, land-use, and safety standards relevant to the jurisdiction in which the property is located. Each jurisdiction will have its own processes but normally draft plans are submitted with an application, permission is granted or withheld, and the process leads to a final inspection in order to confirm that the proposed work is complete and in accordance with the permit issued. This leads to the “open” building permit being “closed”.

The title insurers have taken the position that if a building permit has simply been ‘applied for’ meaning it has been ‘opened’ then the permit has been ‘obtained’. We don’t agree. The coverage would be essentially useless if ‘obtained’ is read to mean ‘applied for’ or ‘opened’. There could easily be hundreds of thousands of dollars worth of work that remained to be completed after a building permit was simply ‘opened’. For the coverage to make any sense it has to mean obtain a closed building permit. This is particularly true given the instructions the title insurers give their lawyer agents that they do not need to conduct searches of the Building Dept.. Searches that could have revealed that the permit had yet to be inspected and closed! I will have more to say on this subject in my next post dealing with “Local Authority Search” coverage but it is also worth noting here that open building permits have been found to go to the root of title which would allow an additional avenue to claim under the marketable title parts of the policy. (See for example: 1854822 Ontario Ltd. v. The Estate of Manuel Martins, 2013 ONSC 4310 per Wilson, J.: “In my opinion, the open building permit is not a minor defect; rather, it goes to the root of title and constitutes a valid objection to title.”)

Building Permit coverage is canvassed in depth in Gemeinhardt v Babic, 2016 ONSC 4707 (CanLII) where, after reviewing various (disappointing) denials made by the insurer, the Ontario Superior Court of Justice ordered:

“Stewart Title shall pay the sum of $592,941.41 to Ms. Gemeinhardt being the replacement cost of house, additions and garage.”

It can be very useful and valuable coverage. So, do not despair, help may be available to you.

On December 12, 2024, the lawyers and staff of Davidson Cahill Morrison LLP celebrated the holiday season together with a family style lunch at Gusto 501.

It is not uncommon for a car accident victim to subsequently suffer further harm through medical negligence while being treated for accident related injuries. This decision illustrates the importance of understanding the interplay between medical malpractice and statutory accident benefits.

At first “blush” this Exclusion appears to exclude just about everything. Regrettably we have seen denials from title insurers that reference this Exclusion in a very aggressive way. Title insurers, and the lawyers that sell their policies, suggest to Insureds that they can make claims on their own behalf.

Davidson Cahill Morrison LLP has been recognized in the 2025 edition of Best Law Firms™ – Canada, a testament to its unwavering commitment to legal excellence. Ranked by Best Law Firms in 3 practice areas and regionally in 3 practice areas, Davidson Cahill Morrison LLP has distinguished itself in the legal industry, earning this prestigious accolade.